Ignorance might be bliss but not every single time. Something you can not change at any cost is good to be ignored.There is no point worrying about something you have no control over. It only wastes your time and energy. If you are running a startup then knowledge and hard work are the absolute metrics to live by than the vague ones like luck and ignorance.

In a startup, there are just too many things at stake to be ignored and setting up a good vesting scheme is the last that you would like to ignore. Which bring us to the question, what do we mean by a vesting scheme for a startup. It simply is the method that helps you split equity among the startup co-founders, investors and certain employees if so needed in future. It saves you and your company from someone who may just get away with your share. It saves you from potential disputes and maybe, regrets in your life.

Here is how you can set up a vesting scheme for your startup

Part 1

Founders’ Pie By Frank Demmler

Notice the elements in the table below.

Your next job is to establish the relative importance of the elements by weighing each on a scale of 0 to 10. A tech startup ‘idea’ is fair to be weighed 7 or 8 whereas an idea of a restaurant may be weighed only 2 or 3. Similarly, a business plan may weigh less if the founders themselves are putting in the money by themselves. Same goes for other matrices too.

In the table below, you got to fill the columns as per the individual founder’s contribution to that field. One who brought the idea to the table can be given 9. One with great industry connections can be assigned a better on the scale than other for this matrix

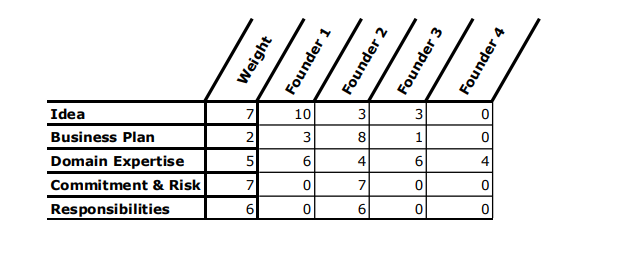

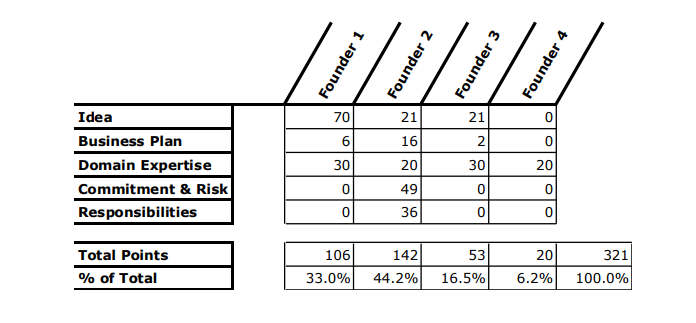

Let’s take a hypothetical scenario and see how things turn out. Read the tables below and analyse.

The relative importance of the elements

Relative contributions of the founders

Now, when you have a fair idea of the equity split, let’s learn about the second step which is vesting scheme.

Part 2

If you are unsure about the risk-taking capabilities of your co-founders and fear that they might leave the relay in between, leaving you helpless, then you are not wrong to think like that. Setting up a vesting schedule is very important. You can not just your co-founder walk away with 20% of company share if he/she chooses to quit too soon.

Here is how a vesting schedule for a cofounder number 2 from the above table may look like.

He/she has 44.2% of the company on paper, right? Unfortunately, that founder decides to leave the company or get fired within a year then as per your designed vesting terms he/she walk away with nothing. After the one year point, you get 25% of your stock and every month after that he/she gets an additional 1/48th of their total stock. This way they only earn all of their stock at the end of four years. Clean and clear, right?

Through the vesting scheme, you decide you can also understand what happens if an advisor, a board member or a co-founder is added later to the team.

Main Image: © Pop Psychology

Be First to Comment